When the Banks Go Bust

14 March 2023

No doubt Financial Friends will have heard over the weekend and to date, that the Silicon Valley Bank (SVB) has sent ripples through the world of banking by going bust. Signature bank have also been taken over by regulators.

Both banks are of US origin but SVB has a UK arm. The UK arm has been taken over by HSBC at a cost of £1. This partly due to intervention by Rishi Sunak it appears.

Will the ripples turn into waves and cause serious trouble? What has happened does matter, but swift action by authorities seems to have stabilised markets. Banking shares tumbled even though savers with deposits were assured their money was safe thanks to Joe Bidens intervention.

I keep a watching brief as this unfolds as banks have tentacles that spread into all sorts of cross-party financial arrangements that could yet be discovered and become of concern. We hope not.

The underlying problem appears to be that the working model of SVB did not allow for the shock of sharply rising interest rates which brought down the price of US treasuries they held (US equivalent to UK gilts). Forced selling at depressed prices to provide liquidity appears as the iceberg that sunk the ‘titanic’ despite confidence in the banking system.

Your Portfolio

Holding our preferred portfolio could be seen as positive against this uncertain background. Inflation linked bonds (lending to the major economies with index linked return on the money lent) saw a sudden rise of 5% between Friday, when the news broke and close of play on Monday (yesterday).

Gold rose by 1.65% yesterday whilst infrastructure funds fell modestly. Drip feeding funds monthly into equities will benefit from falling equity prices scooping up holdings at low prices to gain when equity markets rise again.

Would You or Wouldn’t You?

Website Money Facts on 7th March provided some of the highest rates available within the tax-free ISA framework.

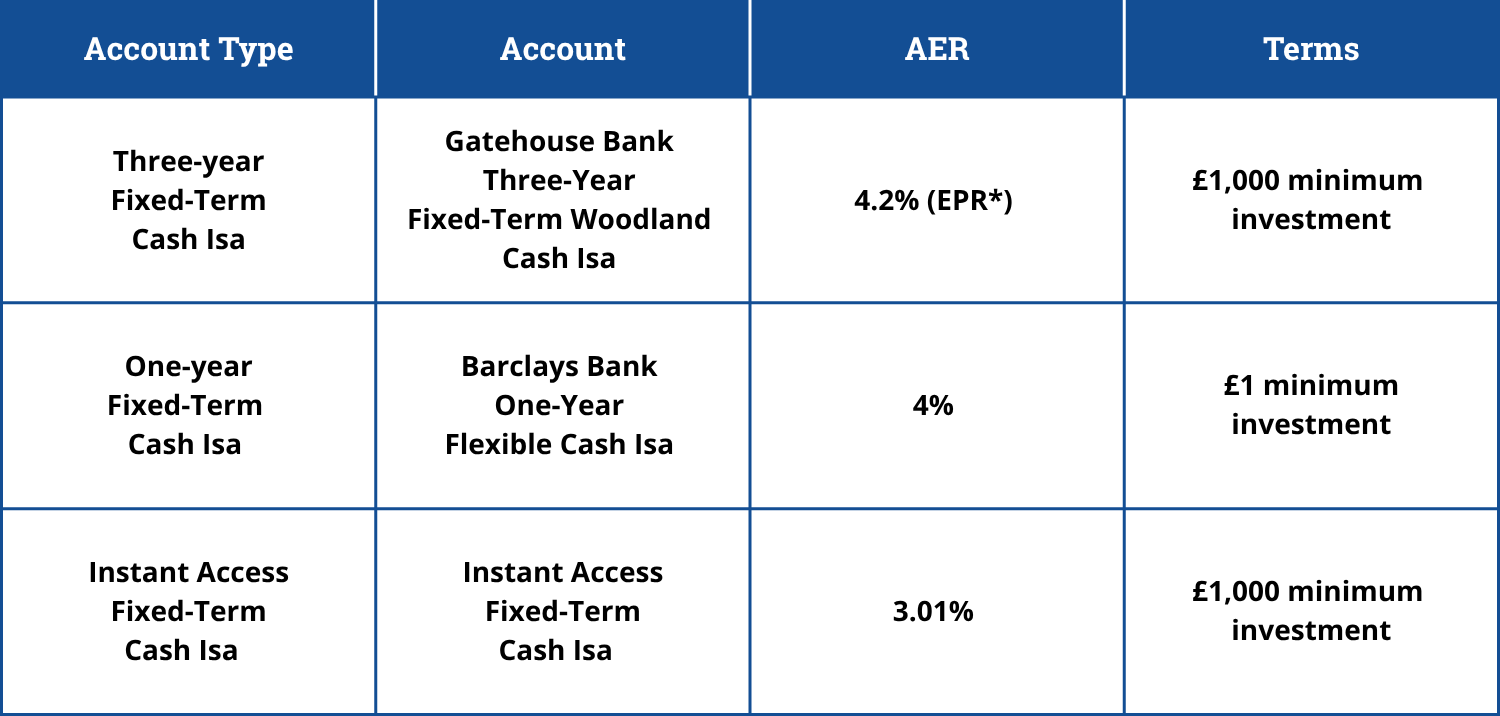

What Are the Current Top Rates for Cash Isas?

The table below shows the top rates for restriction-free fixed-term and instant-access cash Isas, ordered by term.

Source: Moneyfacts. Correct as of 7 March 2023, but rates are subject to change. *The accounts from Gatehouse Bank are Sharia-compliant, so they pay an expected profit rate (EPR) as opposed to an annual equivalent rate (AER).

Two of the three banks shown are likely to be smaller and unknown to you? With what has just happened in the US would you take the 4.2% top rate?

Believe It or Believe It Not?

Inflation linked bonds took severe falls over the last 12/18 months just at the time logically when they should have risen steeply as a hedge against rocketing inflation.

Believe it? The industry does not seem to agree on the reason why this happened. The rumour (or the truth?) in the industry is that over wealthy oligarchs held swathes of these UK bonds. When sanctions hit Russia over Ukraine they sold their holdings causing the crash in price. Believe it not?

What you might believe is that the price of inflation linked bonds and the environment around them makes them appear a buying opportunity at the moment

Subscribing Financial Friends know they can use the Hotline to Harris facility to book a time to gain guidance and information and the helping hand needed.

Click the link and book a time to talk things through:

PLEASE NOTE: A financial or economic commentary like these, are written to explain, interpret or give an opinion on economic events and markets to help readers understand what’s happening and why it matters. Designed to help you make informed decisions of your own by making you aware of opportunities, risks and potential rewards in the market.